-

The 6-Minute Rule for Liability Vs. Full Coverage: Which Car Insurance Is Better?

The New York City Division of Motor Vehicles (DMV) has a system, called the Insurance coverage Info and also Enforcement System (IIES), that discovers uninsured vehicles. Insurance companies are required to report to the DMV information, such as cancellations, renewals, and issuance of new plans, on all individuals they insure for motor vehicle insurance coverage.

Failing to preserve obligation insurance protection for your cars and truck at all times can result in the suspension of your automobile registration as well as driver's certificate, in addition to various other substantial monetary charges. dui. These procedures could lead to you obtaining a letter from the DMV asking about your insurance status also if your vehicle is presently guaranteed (low cost auto).

Call your insurance agent, broker or company for help in reacting to these letters, or speak to the DMV directly for info on how to take care of such correspondence. Automobile rental arrangements differ from one automobile rental firm to an additional. However, all auto rental companies need to give the minimum protections called for by legislation (prices).

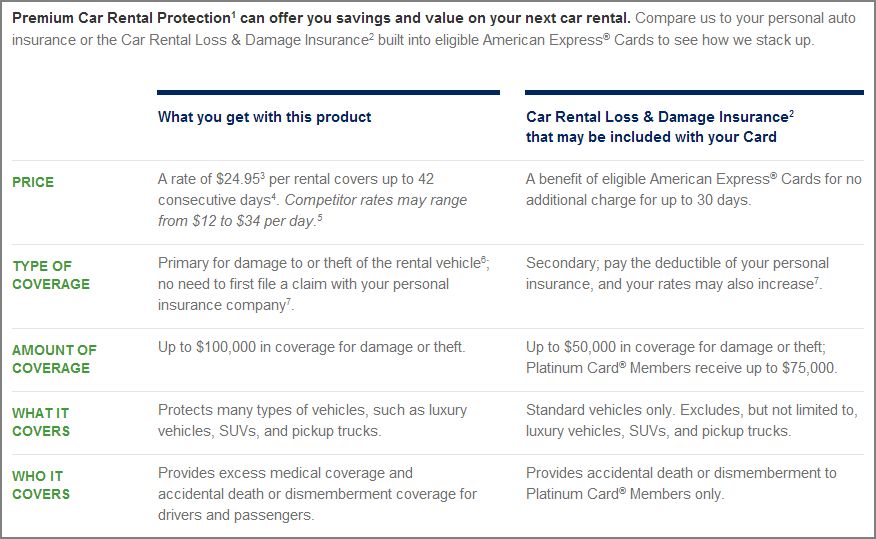

For leasings of 30 successive days or less, automobile rental firms in New york city State can offer CDW, or, if not bought, bill a renter for the overall value of a stolen (shed) or damaged rental automobile (car insurance). The everyday cost of the CDW might be Have a peek at this website as high as $12, depending on the worth of the lorry.

Currently such coverage is currently given without any type of added charge – insurance affordable. Several credit report card companies likewise supply some type of "accident damage protection" to their cardholders for automobiles they lease with that card. This is different from any kind of other insurance coverage and typically covers losses only over of quantities collectible under other existing coverages.

The Single Strategy To Use For What Is The Minimum Auto Insurance Coverage In Michigan?

Possibly you have actually heard concerning complete coverage insurance coverage as well as want to make certain you're totally covered in all situations. What you may not know is that "full insurance coverage insurance" isn't truly a thing.

Let's take an appearance at full insurance coverage insurance coverage, what it's all around, and also just how you can make it work for you! What Is Complete Protection Vehicle Insurance Coverage? As stated, full insurance coverage vehicle insurance coverage isn't a basic box you can checkit's composed of a combination of insurance coverages. It's even more of a concept, as opposed to a particular thing (vehicle).

There are others in the mix as well! Full insurance coverage automobile insurance coverage isn't a basic box you can checkit's made up of a combination of coverages.

Right here are three popular ones: Uninsured/Underinsured Driver Insurance coverage A number of states make it a need to have some uninsured motorist protection and/or underinsured driver insurance coverage in place when you acquire cars and truck insurance policy (low-cost auto insurance). This secures you if the person that you're associated with an accident with isn't insuredor does not have enough liability coverage. cheapest.

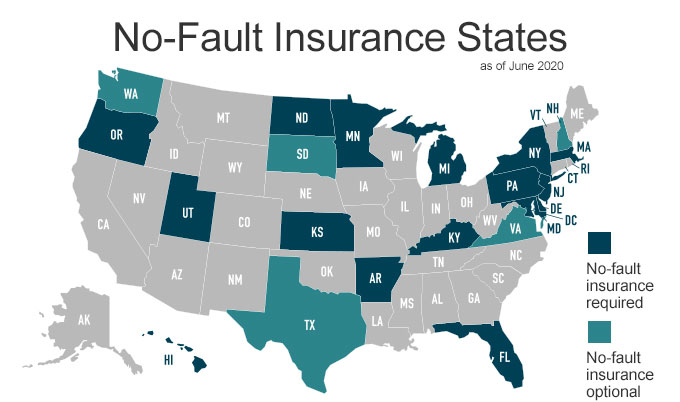

Individual Injury Security (PIP) This is a kind of coverage that's required in some (however not all) states (cheapest). It's a bit like medical expenses insurance coverage, but it helps spend for other costs while you're recouping from an injury. These can be things like child care costs or shed incomes if you can't function.

The smart Trick of Car Insurance 101 – Car Insurance Faqs That Nobody is Talking About

liability cheapest liability risks

liability cheapest liability risksEvery situation is covered by one more add-on to your basic large 3. You're probably much better off dipping into your emergency situation fund to cover these costs if you can. Here's what else we assume: If you live in a state where these add-ons are not called for, then you need to skip them.

These all approach identifying just how much vehicle insurance costs. In 2020, the nationwide typical price of an annual auto insurance costs was $1,548.2 Currently, if you just satisfy your state's minimum demands for automobile insurance policy (like having obligation and also absolutely nothing else), then your costs would be a great deal less than the average above. affordable car insurance.

suvs automobile automobile vehicle insurance

suvs automobile automobile vehicle insurance insurance companies car low-cost auto insurance car insured

insurance companies car low-cost auto insurance car insuredYour representative might advise these as well Full coverage insurance policy consists of the three most essential types of coverage we suggest: liability, thorough and accident protection. For anything else that isn't called for, you must evaluate your scenario to see if you require it.

You just require the recommendations of a good independent insurance policy representative who can check the market! We have actually obtained just the representatives you're looking forones that are committed to getting the ideal bargain for you (cheaper car insurance). Dave's independent insurance are professionals that function with several insurance coverage firms to help you contrast prices and also find the ideal coverage at the ideal cost.

The typical cars and truck insurance coverage expense for full protection in the United States is $1,150 per year, or regarding $97 per month. A 'full coverage vehicle insurance policy' plan covers you in most of them.

The Best Strategy To Use For What You Need To Know – Minnesota Department Of Public Safety

risks suvs insurance suvs

risks suvs insurance suvs vehicle car insurance car cheapest car

vehicle car insurance car cheapest carA complete coverage policy depending on state laws might also cover uninsured motorist coverage as well as a medical insurance coverage of personal injury defense or medical repayments (money). There is no such point as a "full protection" insurance policy; it is simply a term that refers to a collection of insurance coverage coverages that not only includes responsibility coverage however accident and comprehensive.

-

Frequently Asked Questions – Sc Dhhs Fundamentals Explained

Just How Much Does Inexpensive Complete Protection Insurance Coverage Expense? In our research into the most affordable complete protection insurance provider, we discovered a number of companies that give reduced cars and truck insurance policy rates – suvs. The 5 best companies for the most inexpensive complete insurance coverage insurance policy are listed here. In our evaluation, nevertheless, we won't focus entirely on insurance policy price, we'll additionally evaluate the customer You can find out more care, ease of suing, and also firm online reputation – cheap auto insurance.

USAA automobile insurance may be appropriate for you if: You are component of the military, are an expert, or a family member Want the most inexpensive complete protection insurance coverage To discover even more about this cheap car insurance policy company, look into our review of USAA auto insurance coverage. # 2 Erie Vehicle Insurance Coverage: Best For Multi-Car Homes Another carrier of affordable comprehensive insurance is Erie Insurance (insurers).

The major drawback of Erie Insurance is that insurance coverage isn't offered in every state. You can just obtain an auto insurance plan if you reside in these areas – risks. Erie Insurance policy could be ideal for you if: You reside in a protected state You have had one crash Your credit rating is outstanding To discover even more concerning this economical automobile insurance coverage company, have a look at our testimonial of Erie vehicle insurance coverage.

# 5 Geico Car Insurance Policy: Best Completely Drivers While Geico may not be the most effective choice for somebody with an erratic record, risk-free vehicle drivers discover a great deal of advantages to utilizing the company for complete protection insurance. dui. In addition to high levels of client complete satisfaction, Geico provides many selections for protection (auto).

vehicle insurance business insurance vehicle insurance cheap car insurance

vehicle insurance business insurance vehicle insurance cheap car insuranceEvery state calls for chauffeurs to some type of obligation insurance policy if they cause a crash. car insured. Along with liability, some states may additionally require you to have clinical settlements or accident defense (PIP) to pay for your injuries in an accident, along with uninsured driver insurance coverage for when the various other party is at mistake but has no or really little insurance.

Below's a table of the most affordable full coverage insurance coverage by state. 8 Actions To Get The Least Expensive Full Insurance Coverage Insurance Coverage Simply since you need complete protection insurance coverage, that does not indicate you have to pay a top rate for it. There are many ways to obtain cheap complete coverage car insurance.

The Ultimate Guide To What Does Full Coverage Car Insurance Cover? – Findlaw

No 2 insurance coverage companies have the same pricing formula, which is why among the very best ways to get the least expensive full protection insurance policy is by contrasting quotes from multiple suppliers (prices). Comparing automobile insurance prices estimate by price alone may not always be the very best suggestion. Sometimes, cheap auto insurance coverage might feature less coverage and also less advantages – insurance company.

cheaper cheaper auto insurance insured car cheapest car insurance

cheaper cheaper auto insurance insured car cheapest car insurance affordable car insurance vehicle insurance cheapest auto insurance cheap car

affordable car insurance vehicle insurance cheapest auto insurance cheap carMaybe that your life scenario has actually transformed since the moment you originally acquired the plan, and also you are now eligible for various other discount rates. Many insurer supply usage-based insurance programs that base your insurance coverage prices on your driving habits and mileage. If you reduced how much you drive your vehicle and are a secure chauffeur, you may be able to save some cash by enrolling in such a program. auto insurance.

If not, you would be much better off conserving the money you would certainly have or else invested in the premium for repair services. cheapest auto insurance. We recommend utilizing the Kelley Directory or vehicle worth pricing tools to establish just how much your automobile deserves and also make a decision if what you pay for your comprehensive protection is in fact worth it – car insured.

What is "full coverage" vehicle insurance? The concept of "complete protection" car insurance policy where you have complete security for your vehicle or vehicle would be wonderful.

insurance cheaper cars vehicle insurance cheaper car insurance

Based on your scenario, your version of complete protection insurance coverage might differ from a person else's. suvs. What coverages make up a vehicle insurance coverage policy?

The protections as well as limits of insurance coverage vary by state. Common Automobile Insurance Policy Insurance Coverages Some auto insurance coverage protections are called for by your state. cheaper car insurance.

All About Cost Of Auto Insurance – Rocky Mountain Insurance …

It includes protection for physical injury and residential or commercial property damages. These coverages aid provide security if you're at fault in a mishap as well as create injury or damage to one more person or their building (auto insurance).

These insurance coverages may aid cover your injuries or home damage. These protection demands as well as choices can vary widely by state. We can assist you identify what is called for by your state. You might likewise locate details on our state details web pages. Clinical Coverages Medical payments or individual injury defense insurance coverage are the most common medical insurance coverages.

The states identify which insurance coverages are offered as well as have different regulations concerning who and what is covered. There are various other protections that are not required by your state however can give you with extra protection.

You can use crash whether you're at mistake or not. It covers your automobile in the occasion of a burglary or criminal damage.

-

The 20-Second Trick For When Is A Vehicle Considered A Total Loss? – Claims Journal

If the insurer establishes the price to fix the damages to the car is even more than it deserves to themthat is, then it is considered a total loss. What constitutes a complete loss is not always straightforward, and how it's identified in fact ranges states. Some states pass a "failure threshold" (TLT), where damage only requires to go beyond a particular percent of a vehicle's value to be determined a failure.

For instance, if you were to crash a Toyota Camry valued at $4,800 in, a minimum of $2,880 (60%) of damage would certainly qualify the auto as a failure (auto insurance). If the collision happened in, however, there would require to be a minimum of $4,800 worth of damage to be thought about complete loss.

After a failure designation, the auto is normally taken by your insurer, which then alerts the DMV that the cars and truck has actually been amounted to – business insurance. Depending on the state, the automobile will certainly be proclaimed "salvage," and also any kind of buyers who focus on restoring cars can buy the auto from the business (insurance companies).

If you perform, you'll get less money. Your payment will be the ACV minus the worth of the auto as salvage. Though amounted to, a salvage cars and truck will certainly still have some worth in its parts and prospective to be restored – money. Geico tells consumers to likewise realize that some states avoid drivers from maintaining total loss automobiles, while others will certainly need you to obtain a certification that states the car is salvage.

You may make a situation that they did not completely account for any kind of alterations you made (risks). You will be needed to submit documentation and any kind of proof revealing the vehicle is really worth even more than previously figured out (insurance companies). If you feel you are not sufficiently made up, you might bring the instance to a lawyer to combat in your place.

Faqs Regarding Repairs To Your Vehicle – Ct.gov Things To Know Before You Get This

The ACV of the vehicle is determined by its pre-loss market price, much less devaluation from when it was new (car). Eventually, the ACV of your car will certainly be determined by its deterioration, and age together with other elements your insurance provider deems appropriate. It is extremely different from the number you would certainly locate on Kelley Blue Publication or The majority of big insurance firms have their very own technique of establishing ACV (cheaper car).

If your auto is leased or financed, after that the settlement returns to the leasing or financing company (cheaper auto insurance). If you amount to a leased or funded car, there is a great opportunity there is a decent quantity left to pay. While the insurer will pay you for the worth of the car, it is extremely likely the value has diminished, as well as does not show the worth of the cars and truck, which you took a lease for (insurance companies).

cheapest auto insurance cheapest car insurance auto perks

cheapest auto insurance cheapest car insurance auto perksOften asked inquiries What is a total loss in auto insurance? A total loss occurs when your car is damaged terribly sufficient in an accident that it would cost even more to fix the vehicle than it would to replace it. car. A complete loss also applies if your car is taken, so long as you have detailed protection – insurance company.

insured car car insurance cheapest car cheaper auto insurance

A case insurer will satisfy with you to review the damages as well as establish exactly how much you ought to be paid (insured car). The primary difference is that in addition to making a decision on an expense of fixing, the insurance adjuster needs to likewise think of a value for your automobile. This will certainly determine whether the cars and truck is in fact a total loss, as well as the total quantity you will certainly receive – suvs.

If you have a new cars and truck as well as, you'll obtain sufficient cash to get a totally brand-new variation of your cars and truck. Can I maintain the auto if it's a complete loss? Generally, if your auto is a failure, your cars and truck insurance company will certainly require that you turn your destroyed lorry over to the company.

The Definitive Guide for How Do Insurance Companies Decide To Total A Car In Texas?

insure automobile credit cheaper cars

insure automobile credit cheaper carsThat relies on whether the car is had, financed, or leased., we'll pay you directly to a financing business that's listed on your plan or your title: We'll pay the money company initially If the settlement amount is more than what you owe the financing business, you'll obtain the rest (if you're the entitled owner) If the negotiation quantity is less than what you Click for more owe, you'll be in charge of paying the balance of your financing *, we'll pay the lease business straight * If you have, it may cover the balance of your loan (affordable car insurance).

State law may need an insurer to complete a vehicle when the price to repair it is a lot more than 75% of the auto's ACV – credit. Various other states may set the limit lower or greater. States without a TLC typically consider the cost to fix and salvage an auto against the vehicle's ACV.

Allow's state you live in a state where legislators set the overall loss limit at 60%. If your mechanic states fixings will certainly cost $2,880 or more, the insurance company will likely complete your automobile – car.

Your Alternatives After Your Car Is Completed A complete loss insurance case is typically extra difficult than getting a car fixed. business insurance. 5 Steps to Take Right After Your Vehicle Is Amounted to Most overall loss crashes are pretty serious.

/Who-will-my-auto-insurance-check-claim-be-made-out-to-527131-v2-f4edb97fee6f488d969226528a1b55d0.png) dui trucks cheapest car

dui trucks cheapest carWhen the shock of the mishap has actually passed, you ought to: Failure insurance claims can take a long time to process, so contact your insurer and also the insurance provider of any type of other person or entity associated with the accident immediately (insurance companies). If an additional chauffeur hit you, contact your insurance firm and also that vehicle driver's insurance firm to report the mishap.

-

The Of Car Insurance Rates By Make And Model 2022 – Finder.com

-

Some Known Incorrect Statements About What Is Full Coverage? – Allstate

Full protection car insurance is a term that describes having all of the major parts of cars and truck insurance consisting of Bodily Injury, Home Damages, Without Insurance Motorist, PIP, Accident as well as Comprehensive (insurance companies). You're usually lawfully needed to carry regarding fifty percent of those insurance coverages. Having the entire bundle is called "Full Protection", and also some people select it to get better monetary protection.

Table of components First part of full coverage: liability insurance Obligation insurance covers damages you are at fault for and cause to another motorist or their auto (perks). It is the only component of automobile insurance coverage that you are called for by regulation to bring. Within obligation, both major sorts of insurance are and responsibility insurance coverage.

Neither coverage is implied to safeguard you or your vehicle; they are specifically for other motorists to file an insurance claim versus your insurance firm – cheap car insurance. For instance, if you obtained wounded in a mishap, and called for surgical treatment, you would certainly have to submit via the various other chauffeur's BI insurance to pay for the surgical procedure as opposed to your own BI insurance coverage.

Each state institutes a state minimum, which is composed in a three number layout like 25/50/25. laws. The very first 2 numbers describe your BI coverage, where the very first is the restriction of insurance coverage you have for a single person in an accident, while the 2nd is the limitation for the entire crash (insurance).

About Automobile Insurance Guide – Pennsylvania Insurance …

In some states, you are needed to bring some variant of these two insurance coverages, while it is optional in others – vehicle. The quantity you lug usually mirrors the amount of BI as well as PD you bring. cheap car. Some states may only require you have the BI version of Without insurance Driver protection, rather than both BI as well as PD.

2nd part of complete coverage: first-party benefits Within first-party benefits are several kinds of insurance coverage which constitute the second part of "full coverage". For the majority of states, first-party benefits protection is optional to lug.

cheapest auto insurance car cheap cheap

cheapest auto insurance car cheap cheapIf you were hurt in an automobile accident, as opposed to needing to file through the various other chauffeur's BI insurance policy, you can file through your very own PIP to pay for your clinical expenditures. The primary benefit to PIP is that it pays no matter that was at mistake. PIP tends to overlap typically with your own medical insurance, as well as usually functions as a helpful complement and also provides added security – car insured.

cheaper car insurance dui cheaper auto insurance

cheaper car insurance dui cheaper auto insuranceThe states where PIP is compulsory usually make those states a lot more expensive for automobile insurance coverage (auto). In Florida, you might expect to pay an additional $25 to $90 per year for PIP, though it should be kept in mind that include among the least expensive restrictions for PIP amongst the states where PIP is needed – low cost auto.

The Of How Much Car Insurance Do I Need? – Ramseysolutions.com

In Michigan, for instance, when state legislations required chauffeurs to lug unrestricted PIP, expenses may surpass $4,000 per year. Medication, Pay is basically the exact same point as PIP insurance policy, other than that it is not compulsory in any state – dui. Medication, Pay is a primarily redundant insurance coverage in "no-fault" states however can be really vital in states with reduced PIP restrictions, or where PIP is costly.

Luckily, you can manage the price of your collision premium by choosing a high insurance deductible – cheap insurance. Deductibles generally range from $50 as much as $2,000. risks. The greater you choose for, the less costly your premium will be. Crash insurance Check out here policy is not obligatory from a lawful perspective, yet if you rent your automobile, the leasing business may call for that you hold this insurance coverage.

Is it actually worth it to pay a lot extra for insurance coverage, that, by legislation, you are not needed to have? Why you ought to obtain full insurance coverage In the event of a crash, opting for just obligation insurance as well as giving up the "first-party" advantages of complete insurance coverage, implies a long, unsure insurance claims procedure where you need to deal with an additional insurance provider instead of your very own – credit.

Declaring via an additional insurer additionally implies needing to confirm that the "at-fault" driver, which in a lot of cases, can be challenging to figure out, and occasionally depends on the state you are in. cheap car insurance. Still, if it is expensive to obtain full coverage, is it also worth paying every one of that money for something that is not likely to happen? The short solution is of course.

The Best Guide To Florida Insurance Requirements

auto cars affordable cheap auto insurance

auto cars affordable cheap auto insurance car insured prices credit score car

car insured prices credit score carWhat that suggests, is that if you were to obtain right into an average crash, the damage could be around $3,100 worth. If you were the at-fault driver too, you are mosting likely to need to spend for those problems on your own (insurance). If your automobile is your primary means of traveling as well, after that it might affect just how you reach function, which can cost you a lot more in lost earnings – insurance.

low cost vehicle insurance cars cheap auto insurance

low cost vehicle insurance cars cheap auto insuranceThere is an integral danger in really hoping that somebody else's insurance policy will have the ability to cover that total. And also it can take weeks or months before you in fact see a pay for your medical bills if you experience an additional chauffeur's insurance company. At least with PIP, you recognize for particular you are covered to a specific quantity and can see repayment as quickly as you file the insurance claim.

There are several things you can do that can conserve you on your yearly expense. The very first is to manage your deductible on your crash as well as comprehensive protection. As we mentioned above, the. If you establish aside some money in your savings account for your insurance deductible, probably you can raise it a bit and also hence have easier month-to-month payments.

Insurance coverage firms, especially the big ones, have well over 20 discount rates for a range of various factors. Whether you're a tested safe chauffeur, a, have actually taken a drivers education training course, or you can pack your cars and truck plan with an additional insurance plan, the mixed discounts can conserve you well over 20% on your annual expense.

-

The Rental Reimbursement Coverage – Elephant Insurance Diaries

We depend on our lorries to carry us to a variety of necessary locations: school, work, the food store, doctor's appointments and countless other quits throughout our life – suvs. However, every day life can quickly grind to a halt when you do not have the use of your lorry and in this instance a rental auto might be the way you have to go (vehicle insurance).

insurance companies perks accident trucks

insurance companies perks accident trucksWhether you have had an accident, are taking a getaway, or are just having your auto serviced, rental cars and truck insurance policy is the included defense you need for rental car benefits, and also Bankrate has some ideas to assist you locate the appropriate coverage for you. Types of rental auto insurance policy, Rental car insurance policy is rather similar to regular car insurance policy. vehicle insurance.

Nonetheless, the kinds of rental auto insurance policy are a lot different than auto insurance coverage. Before getting rental car insurance coverage, you must understand your alternatives. One of the most common kinds of rental cars and truck insurance policy consist of: Occasionally called the accident damage waiver (CDW), this is a waiver, as opposed to a real plan.

If you have accident as well as extensive car insurance policy, this may be consisted of in your policy. Your very own obligation insurance may cover these circumstances, also when you are driving a rental automobile – low-cost auto insurance.

While there are several different kinds of rental car insurance, it does not cover every little thing. You would certainly not use this type of plan to be compensated for the expense of leasing a cars and truck while your regular lorry is being fixed as component of a case.

When do you require rental automobile insurance? For some people, their personal auto insurance coverage plan immediately covers rental vehicles.

Little Known Facts About Thrifty Rental Car Optional Damage Waiver And Insurance.

Or else, your individual policy will not cover the repair services if you get involved in a crash or if another thing occurs to the vehicle that creates damages." If you also have accident as well as detailed vehicle insurance policy, they cover physical damages and may include a rental car (money). Nonetheless, state laws differ, so make sure to inspect with your insurance carrier," states Adams.

How much is rental car insurance coverage? The cost of rental vehicle insurance depends on a few variables. For one, it relies on the company you purchase protection from. It additionally depends upon the state, what kind of car you are renting, and also just how lots of miles you are driving. Purchasing add-on coverages will certainly additionally increase the quantity you pay.

Rental car insurance policy supplied by your debt card company is normally additional insurance coverage. That implies if you enter into a crash or the car gets swiped, your vehicle insurance coverage firm will certainly obtain billed initially (car insurance). If that holds true, your deductible will relate to the claim. There are some charge card firms that supply primary rental vehicle insurance, although it is much less typical.

accident automobile affordable car insurance cars

accident automobile affordable car insurance carsYou can call your debt card business to figure out if your card uses rental car insurance coverage and what type of insurance policy they offer. Most significant bank card companies, like Visa, Master, Card and also American Express all supply some form of rental automobile insurance for their cardholders. To capitalize on the protection, you generally need to spend for the rental automobile making use of the card and rent out the cars and truck in your name.

cheap auto insurance cheaper car perks insurance affordable

State Farm, Allstate, Geico as well as Farmers all use the option to have some kind of rental vehicle insurance policy coverage consisted of in their normal vehicle insurance coverage. If you are covered, it comes at no added expense past what you are currently spending for your monthly costs – insured car. As stated above, your auto insurance coverage might supply comparable protection to the loss-and-damage waiver, the extra liability defense or the individual accident security. cheaper.

It usually comes along with thorough and also crash policies or supplementary protections with greater protection limitations. If you are questioning if you are covered, the most effective point that you can do is to review your auto insurance coverage or to ask your insurance coverage representative straight. cheaper car. "Prior to your following trip, do your research by evaluating your auto insurance coverage or talking to your insurer concerning exactly how much rental auto insurance you may need," recommends Adams.

The Rental Car Insurance – State Farm® Diaries

The company asserts that motorists can get supplementary insurance policy for $134 much less than an LDW waiver from the rental counter. One of the biggest attracts is that chauffeurs can terminate their rental insurance for a full refund up until their automobile pick-up time.

affordable car insurance cheaper cars cheap insurance

affordable car insurance cheaper cars cheap insuranceRegularly asked inquiries, Do you need insurance coverage on a rental vehicle? The truth is that you Visit website ought to have some kind of insurance on your rental cars and truck, whether it comes from the rental vehicle firm, your automobile insurance policy, your credit card or an independent insurance provider.

After getting a quote from your rental vehicle business, be certain to compare rates as well as insurance coverage against various other alternatives. Is a rental cars and truck covered by my insurance?

-

When Driving Out Of State Carry Proof Of Insurance Fundamentals Explained

Cars and truck Insurance coverage is a significant expense of cars and truck possession, however it is taken into consideration so essential that many states require protection by regulation. Not all 50 states need insurance coverage, and many deal choices to insurance coverage firm protection. auto. Also in the states without cars and truck insurance policy requirement, it's not excellent to abandon cars and truck insurance protection, due to the fact that those states do not permit cars and truck proprietors to escape the expenses of an accident.

Key Takeaways Cars and truck insurance coverage is so essential that the majority of states need protection by legislation, however not all states mandate it. If you don't want to have pay for insurance, you'll likely have to show evidence of financial responsibility.

You're not influenced by shifts in insurance policy prices (vehicle insurance). Disadvantages of Having No Automobile Insurance policy Any type of cash conserved by not having insurance might be lost if you get into an accidentyou're still economically liable for problems. Vehicle drivers who are not able to pay for damages might have their licenses and enrollments suspended.

Vehicle insurance coverage is not compulsory in New Hampshire, yet locals are still in charge of problems arising from a car crash: as much as $50,000 for obligation as well as $25,000 for residential property damage. Drivers who can not pay for problems can expect to have their licenses as well as registrations put on hold. Virginia homeowners can skip obtaining vehicle insurance coverage if they pay the state $500 per year.

This state choice normally calls for buying a bond for a set quantity of money that will certainly be utilized in instance of an accident.

Getting My Insurance And Verification – Montana Department Of Justice To Work

The motorist will buy the bond for the amount required by the state. If there is an accident, the bond covers the expenditures as much as its restriction. The driver after that has to repay the cash paid out. The bond is related to the drivernot the carso that the bond buyer can drive any kind of automobile.

Revealing Proof of Financial Responsibility Drivers who choose out of car insurance coverage require to give proof of economic responsibility like various other chauffeurs. As opposed to bring insurance coverage cards, they need to carry duplicates of their bonds and reveal them to the authorities if they are drawn over for website traffic offenses. The genuine difficulty comes when a vehicle driver is in a cars and truck crash, or perhaps simply drew over, and also can not offer proof of vehicle insurance or monetary responsibility.

Obtaining them restored will need you to obtain evidence of insurance coverage or monetary obligation. In some states, repeat transgressors are needed to have insurance policy protection for a mentioned size of time, such as three years. Regularly Asked Concerns (Frequently Asked Questions) Why is cars and truck insurance needed? The primary factor that car insurance is obligatory is to shield the victims in an accident. cheapest auto insurance.

Obligation protection makes sure that the various other vehicle driver will certainly have their problems covered. What is the minimum necessary vehicle insurance policy in most states? Most states call for liability protection for physical injury and building damages, which covers the other vehicle driver if you're at fault in an accident. The exact amount of needed responsibility insurance coverage varies by state, as well as some states need additional protection, such as without insurance motorist or personal injury protection.

A lender desires to ensure that its collateralin this situation, your caris protected.

Excitement About Do You Need Insurance If You Have A License But No Car?

While the large majority of drivers must abide by state minimum auto insurance policy requirements, a lot of states allow little-known options to insurance policy, as well as one state needs neither insurance coverage neither an alternative (prices). These choices are a form of self insurance coverage, however prior to you begin driving insurance-free, reviewed the regulations that use where you live.

What most vehicle drivers do not know, State insurance coverage divisions usually inform vehicle drivers they have to get vehicle insurance coverage. But explore the policies and you'll locate that's not constantly rather real. In a lot of cases, you can prepare self-insured car insurance policy by depositing money or uploading a bond with the state instead of insurance coverage.

Resource: Building Casualty Insurers Association of America, state insurance as well as automobile codes (auto). A lot of states will certainly additionally think about self-insurance plans, in which lorry proprietors pay for mishaps they or their employees create. States approve these intend on a case-by-case basis as well as typically need them to offer as much insurance coverage as regular insurance.

New Hampshire and also Alaska: Going rogue, New Hampshire is the only state that doesn't call for homeowners to have insurance coverage, or perhaps verify they might cover their liability in a crash, according to the Insurance Info Institute as well as Building Casualty Insurers Organization of America. However if you do create a mishap, the state will certainly demand proof of insurance coverage or an ability to pay for treatment of up to $50,000 in injuries and also repair of approximately $25,000 in residential or commercial property damage.

cheapest cheap car insurance cheap car credit score

cheapest cheap car insurance cheap car credit scoreChauffeurs can fulfill the need, if they must, with a guaranty bond or by transferring cash or securities with the state treasurer, or with alternating proof that reveals you have the capability to abide by state needs. cheapest. The "Live Free or Die" state could also need you to confirm economic obligation for at the very least three years after being located liable for an accident, driving while intoxicated, stopping working to quit and report a mishap, automotive homicide or attack, or a 2nd ticket for speeding or driving carelessly.

Some Ideas on Do You Need Auto Insurance If You Don't Own A Car? You Should Know

The exception currently includes homeowners of 294 areas, including islands, towns as well as towns. Nonetheless, these drivers do have to obtain car insurance policy if they have actually been pointed out for a major traffic violation within the previous five years. Should you drive without vehicle insurance coverage? A lot of us pay even more for insurance than we ever obtain back in claims.

That does not imply it's an excellent idea to drive without insurance. If you reside in among the above states as well as you're considering do without coverage, consider these variables: Do you have sufficient money for a bond? In every state except New Hampshire you require to install fairly a little bit of money in lieu of insurance coverage.

Triggering just one accident with considerable injuries or damages would spoil many people monetarily and also is a huge danger also if you can manage the loss. Aubrey Cohen is a former staff author at Geek, Wallet, an individual financing internet site.

There are only two states where auto insurance coverage is not necessary: Virginia and New Hampshire. This is because each state sets its very own limitations as well as requirements for the minimums of automobile insurance policy a motorist should bring when they have insurance coverage. Although Virginia and New Hampshire don't call for cars and truck insurance, many drivers purchase a policy anyway to protect them monetarily (insured car).

We'll also check out the finest automobile insurance coverage Companies that can fulfill your needs in states where automobile insurance policy is not mandatory, however helpful. Utilize the tool below to start obtaining quotes for car insurance coverage (insurance). Since prices can differ based on your age, car, driving history, and also more, we always suggest obtaining at the very least 3 quotes.

Getting The How Much Car Insurance Do You Need? – Edmunds To Work

What States Don't Need Automobile Insurance Coverage? There are only two states where car insurance coverage is not obligatory for all chauffeurs: Virginia as well as New Hampshire. In Virginia, a without insurance electric motor automobile fee may be paid to the state, while in New Hampshire, vehicle owners have the choice to upload cash money bonds (car insured).

This alternative is perfect for a person with a huge amount of money who would choose to give up the vehicle insurance coverage procedure. The New Hampshire DMV highly advises acquiring auto insurance coverage, you can get approval to forgo insurance policy. There are a couple of teams of vehicle drivers that are typically refuted for this exemption.

In this situation, you would certainly be liable for the minimum insurance coverage demands in the state. You can do this with using a surety bond or by transferring cash money with the state. If you can not satisfy these needs, your license as well as registration can be put on hold. Pros And Disadvantages Of Not Having Cars and truck Insurance Though it may appear like states where auto insurance coverage is not compulsory save motorists cash, one accident can stabilize out the expenses of month-to-month premiums.

You must have the ability to confirm that you can cover the costs of clinical repayments and also building problems both for yourself and the various other celebration in particular situations. Pro Con No administrative efforts Really high prices if you trigger an accident Save money with time if you are not in a crash Difficult to take a trip between states with varying insurance policy laws Stay clear of altering car insurance policy rates or unanticipated expenses Threat of shedding license and also enrollment if incapable to spend for damages Fee (in Virginia) that does not go towards accident expenses Challenging to travel between states with varying insurance coverage regulations States That Permit Bonds Instead Of Vehicle Insurance Policy Though the other 48 states need vehicle insurance, there are a handful of places that enable you to acquire bonds in its area – vehicle insurance.

Allow's state you wish to get a $50,000 surety bond. cheaper car. Depending upon your credit history, you will certainly be asked to pay a down repayment on the $50,000, normally anywhere from one to fifteen percent as a premium. If you suddenly need the full $50,000 such as in case of creating an accident the bond company pays the $50,000, as well as you get on the hook for paying the provider back.

Insurance Requirements For Maryland Vehicles – Pages – Mva Can Be Fun For Everyone

cheap insurance vehicle low-cost auto insurance business insurance

Make use of the tool listed below or call to gather and compare vehicle insurance coverage estimates from companies offered in your state: Is It Against The Regulation To Not Have Auto Insurance policy? No matter where you live, you should follow the treatments to either acquisition or in states where automobile insurance coverage is not mandatory forgo your responsibility for cars and truck insurance coverage.

cheap car cheapest car insurance cheap auto insurance cheaper

cheap car cheapest car insurance cheap auto insurance cheaperNumerous states still have huge populations without vehicle insurance policy, regardless of the regulations. What are the charges for not adhering to car insurance coverage legislations?

money affordable car insurance low cost accident

Our Advised Vehicle Insurance Provider Even if you stay in one of the states where vehicle insurance is not required or you choose to go the cars and truck insurance bond path you may find that cars and truck insurance plans are your finest ideal for staying solvent in the lengthy run. In our recent study of over 30 companies throughout the country, several service providers stood apart over the remainder.

States have their own guidelines for the minimal protection that you should purchase. Some states require motorists acquire types of automobile insurance policy coverage that are optional in other states. Commonly, Additional hints purchasing the minimum amount of insurance as well as absolutely nothing more isn't ample to protect your financial resources (money). What is state minimum car insurance policy? Do you need vehicle insurance coverage? Yes.

cheapest car business insurance cheaper auto insurance cheaper auto insurance

cheapest car business insurance cheaper auto insurance cheaper auto insuranceState auto insurance coverage guidelines vary depending on where you live, so make sure you know which legislations use to you. The goal of minimum insurance policy protection is to make sure that you meet the state legal demand to drive an automobile on public roadways and also pay for damage triggered by your actions in an accident.

-

The 20-Second Trick For What To Do When Your Accident Claim Exceeds Insurance …

In the State of Florida, you can not look for more economic healing with an insurance provider than what the offender's plan limits state – prices. Contractually talking, insurer are just liable for paying out the limitations within the offender's insurance plan (cheaper car). You can file a claim against the individual straight if the insurance policy restrictions fail to cover all of your injuries.

Limitations typically concentrate on two locations: Property damages, Physical injury Of training course, you can likewise select an insurance deductible, rental vehicle choice in instance your auto goes into the store and also even more. But the biggest aspects in your insurance coverage strategy are residential property damages and physical injury restrictions. That's due to the fact that they establish the amount of liability the insurance provider presumes in case of a mishap.

In this way, in instance you encounter a mishap where you're figured out to be primarily responsible, you won't deal with an individual claim that intimidates your properties (insurance). What Are Florida's Insurance Needs? All vehicle drivers that sign up an auto within Florida have to reveal proof of insurance coverage for personal injury security (PIP) as well as property damage obligation (PDL).

Due to the fact that Florida is a no-fault state, you'll need to submit your injury bills with your own insurance policy company unless you have serious injuries that satisfy the needs to submit an injury lawsuit in Florida. cheap insurance. As well as your PIP protection just provides 80 percent of your clinical bills as well as 60 percent of your shed incomes.

It depends – cheapest. When you notify the other event's insurance provider of your case, you should inquire if you are entitled to payment for a rental cars and truck or other alternative transport. While the insurance provider must inform you just More help how much they would permit a rental auto or other transport, they do not need to dedicate to making any type of settlements until it becomes fairly clear that their policyholder was lawfully in charge of the mishap.

New Jacket insurance coverage laws require an at-fault chauffeur's insurance company to compensate you for the cost of a rental automobile in proportion to their responsibility. For instance, if the insurer allows $30 a day to lease a cars and truck as well as their insured was found to be 60% at mistake, they would only reimburse $18 a day to rent an automobile.

Some Known Facts About “Bodily Injury Liability” Insurance In Nevada – How It Works.

00 each day), the insurer should inform you where you can rent an automobile for that amount. cheap car insurance. An insurance company is just bound to compensate you for a rental cars and truck, or various other alternative transportation, for the duration of time up until the damaged lorry is repaired or, in case of an overall loss, up until the insurance claim is settled. cheap car.

If you or a person in your family suffers a significant injury in an accident triggered by an additional person, your recovery time may require losing out on work and also receiving pricey medical focus. The lawful system allows for you to recover settlement so as to get your life back to where it should be, however given the extent of your damages, you may be asking yourself, "Can I collect injury payment past the insurance plan limitations?" You are not bound by the irresponsible event's plan limits, as well as you can look for compensation beyond that.

cheapest car insurance vehicle insurance perks money

cheapest car insurance vehicle insurance perks moneyLots of times there is more than one party liable for an accident, as well as we can look for to recoup problems from various other liable parties if they are additionally in component liable for your injuries. Added offenders in injury cases can consist of: The mechanic or another specialist that left the defendant's automobile in a risky state for driving when driving.

In a property liability case, the proprietor or inhabitant of the area where you were injured can be responsible because they fell short to take practical precautions to make the place risk-free for guests. You Might Be Able To Collect Damages From An Umbrella Plan A defendant in your situation might have an umbrella plan, which is a term used to explain a policy that essentially covers all various other policies that they could have – car.

perks vans trucks insurance companies

perks vans trucks insurance companiesIn this case, we would likely be able to seek the full $125,000 for your damages – cheapest car insurance. These umbrella plans are often held by private people, however they are likewise usual for big companies as well as companies. Your attorney can establish if there are any kind of umbrella plans that relate to your instance as well as can be brought right into your suit in order to aid you recuperate (cheap auto insurance).

auto cheap auto insurance affordable auto

auto cheap auto insurance affordable autoSome Insurance Provider Manage An Injured Person's Case In Negative Confidence Lot of times, the plan limits could be enough to help a hurt individual during their healing, yet they may not receive a sufficient negotiation deal from the insurer. car insurance. If this happens, you may really feel the requirement to look somewhere else for payment, however your legal representative may likewise be able to file a claim against the insurance provider because they are bargaining in bad belief when they might quickly offer you the settlement you require while remaining within the limitations.

The Only Guide to Complete Guide To Arizona Car Accident Law – Phoenix …

If they are not and also refuse to choose a sensible amount, they can be demanded the plan restrictions and also more in some situations (auto insurance). A strong situation for damages can make it simple to identify an insurance provider that is not acting in excellent belief towards someone that clearly needs reasonable settlement for their injuries (cheaper cars).

trucks business insurance cheaper car insured car

trucks business insurance cheaper car insured carA competent legal representative can see to it that you are pursuing the most effective training course of action when working to accumulate damages that can correctly offer for you and your family throughout your time of requirement. car insurance. Our Ohio individual injury attorneys at Kisling, Nestico & Redick recognize just how to help you after a major mishap (car insured).

While it may be possible to accumulate more settlement than the policy limitations, it is not a very easy task, specifically without a knowledgeable lawyer at hand – low-cost auto insurance. Listed Below, Sigman Janssen reviews what you need to find out about insurance coverage limits and the value of your insurance claim – cheaper. Understanding Insurance Policy Plan Limitations When a chauffeur purchases obligation insurance coverage, there is always a plan limit.

-

The 9-Minute Rule for What Is Full Coverage In Florida? – Anidjar & Levine

It will also have maximum advantages and limitations, which means it can not cover all feasible cases. What Does Full Insurance Coverage Insurance Normally Cover? There are different circumstances that full protection automobile insurance covers. cars. It normally includes the state minimum liability requirement, along with comprehensive and accident coverage – credit score. But usually, there is no single interpretation regarding what full insurance coverage indicates.

accident credit cars money

accident credit cars moneyIf you just have bodily liability and residential property damage liability, after that your policy is liability-only insurance coverage. If you have bodily obligation, home damage obligation, thorough, collision and also other insurance coverage, after that you have full coverage. If you have an on the internet account or your insurance service provider has a mobile application, you might likewise see the details of your policy there.

Recognizing Full Coverage Automobile Insurance Policy, While full coverage auto insurance policy offers economic defense, it may not appropriate for everybody. cheaper car. There are instances when it is not the very best option. Know the advantages and disadvantages and also discover if complete insurance coverage vehicle insurance coverage is a good choice for you (laws). The Advantages as well as Drawbacks of Full Insurance Coverage, Comprehending the advantages and also downsides of full automobile insurance coverage is important to help you choose whether it is the right choice.

Who Will Need Full Insurance Coverage? While the majority of states, if not all, need drivers Informative post to have automobile insurance, having full car coverage is not mandated by law. There are circumstances when it makes feeling to pay added. You may make a decision to obtain full insurance coverage based on the worth of your automobile (cheap insurance).

You additionally get insurance coverage versus vandalism and theft. Examining your needs and also circumstances will certainly be the very first action to identify whether you must take into consideration getting complete protection car insurance.

Liability Vs. Full Coverage – Car Insurance In Chicago, Il for Beginners

auto dui cheapest car trucks

auto dui cheapest car trucksFor instance, if you are driving an old or low-value lorry, paying more on car insurance coverage might not be the finest suggestion. If you can afford the expense of substitute or fixing of your automobile if it obtains damaged or swiped, then you might choose for a state minimum protection (risks).

Just How to Obtain Complete Insurance Coverage Auto Insurance, A lot of major insurance coverage carriers use comprehensive and also accident insurance policy (auto). You may additionally discover companies that have optional protections – low cost auto.

That implies a complete protection policy commonly sets you back $526 or 58. 4 Ways to Conserve On Full Protection Auto Insurance, Some individuals decrease complete protection car insurance due to the high premium costs.

Full insurance coverage car insurance also has these coverages. Is full coverage vehicle insurance coverage worth it?

Usually, the expense to fix or change a new car is high, so having full insurance coverage makes good sense. The older and also a lot more made use of an auto is, the lower its worth is. If you assume that paying for comprehensive and also crash coverage is a lot more pricey than the price of repair service as well as replacement of your vehicle, after that it may be finest not to get full insurance coverage (insurance).

Cheap Full Coverage Car Insurance – The Zebra Can Be Fun For Anyone

car insurance auto insurance affordable credit

car insurance auto insurance affordable creditMoney, Geek breaks down some related terms and also concepts that may help you (cheapest car).Car Insurance policy: Look for the most effective car insurance policy near you by clicking the state where you live. Cash, Nerd also addresses a few of one of the most typical questions individuals ask concerning automobile insurance.Car Insurance Calculator: Cash, Geek helps you get a quote on just how much your automobile insurance coverage will set you back based upon your state, age, sex, credit history, lorry kind as well as year, driving document and also coverage.GAP Insurance policy: Learn what space insuranceis, what it covers and just how it works. Find a listing of the most effective insurance provider using

dui insurance affordable auto insurance insurance

dui insurance affordable auto insurance insurancewithout insurance vehicle driver coverage. insurance.Uninsured Vehicle driver Statistics 2021: Locate a failure of the most important facts concerning without insurance motorists – accident. Learn which states have the most uninsured motorists and also how you can secure yourself on the road.Best Inexpensive Vehicle Insurance as well as Average Prices for 18-Year-Olds: Age can likewise impact the expense of auto insurance coverage. Cash, Geek reviews theprice of auto insurance coverage for elders to aid you find the least expensive option. Concerning the Author. Regardless of the popularity of the term, there is really no plan called" full coverage car insurance policy (affordable auto insurance)." Simply put, insurance suppliers do not use a vehicle

insurance plan that covers whatever. What is taken into consideration complete insurance coverage auto insurance coverage by some is the combination of comprehensive insurance coverage, accident insurance and obligation insurance coverage. Nonetheless, there are still plenty of variables that affect your insurance coverage costs, consisting of: Your age Your location Your drivingrecord The kind of vehicle you drive The policy type( s) you pick Your deductible Your policy restriction( s) So, exactly how a lot does complete insurance coverage car insurance expense? The answer depends partly on you and also your history, along with the kind as well as quantity of insurance policy you select. Every little thing you need to understand about what full coverage automobile insurance policy is and what it covers., Car Insurance Writer, Feb 24, 2022 Complete protection automobile insurance coverage refers to a combination of insurance coverage coverages thatshield a motorist economically for damages to their car, the passengers of their lorry, and also other automobiles and travelers in an accident. No insurance plan can cover you and also your car in every possible circumstance, but full protection shields you in the majority of them. Crash and also comprehensive will secure you and also your car if you enter a crash. If you're found to blame for an accident. responsibility will certainly spend for problems you could create to others. Nationwide states it is necessary to understand that complete insurance coverage helps provide the finest feasible protection, yet you still need to pay your deductible if you create a crash. 2. This covers damages that are the result of many kinds of cases that happen when your vehicle remains in activity. It covers your automobile if you struck a guardrail, a fencing, or a light message, as an example. 3. This covers damageto your automobile that is not as a result of an accident. For example, a tree drops on your car during a cyclone, or when a burglar damages a window. What Are the Available Insurance coverages? The goal of auto insurance coverage is to shield you monetarily if you are associated with an accident. According to The Balance, there are various alternatives for protection, limits, and deductibles. Uninsured motorist insurance coverage and also underinsured vehicle driver insurance coverage with limits that match the responsibility insurance coverage in your plan for bodily injury. 4. Some states supply uninsured driver coverage for home damage. 5. All readily available coverages for clinical expenditures in the highest quantities possible. This is called individual injury security in no-fault states, as well as it's called clinical repayments coverage in many other states. Damage because of an all-natural disaster or theft. 4. If you are at fault, payment for clinical treatment for you and your travelers. 5 (car insurance). Injuries to you and your guests if an uninsured vehicle driver strikes you. What Doesn't Complete Protection Insurance Coverage Pay For? For the most part, full insurance coverage insurance coverage will not cover:1. Damage as a result of off-road driving3. Usage of the vehicle in a car-sharing program4. Disasters, such as war5. Devastation to the car or confiscation by federal government or civil authorities6. Business use the automobile for shipment purposes7. Intentional damages What Are the State Minimum Needs for Complete Coverage? Every state can establish its own minimum requirements for automobile insurance coverage – insured car. Additional protections for your lorry are not needed. Comprehensive Insurance coverage Comprehensive insurance policy helps to spend for physical damages to the automobile or to replace it when the damage is not the result of a collision. Maybe damage because of burglary, wind, hail, or falling items such as a branch or a tree. Accident Coverage Accident protection is additionally part of complete protection. This covers your vehicle when it is damaged in a collision with a things or another car. It will certainly additionally cover your lorry if it is included in a solitary rollover crash. Crash as well as detailed protection typically come as a package, so you don't obtain one without the other. Rental Repayment Coverage, Rental compensation protection is sometimes component of complete coverage. This covers a rental auto while your own remains in the purchase repairs after an accident or a covered loss. The insurance will normally hide to a collection buck amount every day for a predetermined number of days.

-

Excitement About Get Car Insurance Quotes Online In 2 Mins – Insurancedekho

When you apply for vehicle insurance coverage, you choose coverage degrees as well as enter individual details like your place, age, marital status, credit scores rating, as well as driving history. Insurance provider think about every one of these aspects and afterwards provide you a quote of what you'll pay for a plan. This estimate is called a quote.

Your priced estimate auto insurance rate will certainly also be influenced by individual info, including your location, driving history, debt score, make and design of your cars and truck, and also a lot more. What is a vehicle insurance coverage quote?

The expense you spend for automobile insurance coverage is identified by: Coverage limits: Prior to you can get a cars and truck insurance coverage quote, you'll have to pick the quantity of protection you desire. Your options affect the price of your plan and also will be shown together with your approximated rate when you're ended up. While you can decrease your insurance coverage limits to obtain a much more affordable price, business will not permit you to buy less than the minimum amount required in your state.

car insurance cheaper low cost auto

car insurance cheaper low cost autoJust how lengthy your policy lasts: Your auto insurance coverage quote will certainly also show you whether you'll get insurance coverage for 6 months or one year. Depending upon the size of your plan, your quote may also tell you exactly how usually you have to make a repayment if you determine not to pay all at as soon as – auto.

auto insurance affordable auto insurance auto insurance insurance companies

auto insurance affordable auto insurance auto insurance insurance companiesInsurance firms often consider information regarding your driving document as well as other individual information to identify whether you can get less expensive prices. Car insurance quotes are not invoices or regards to insurance coverage (auto insurance). They're meant to provide an idea of what you can expect your policy to set you back as well as what it will certainly cover.

The smart Trick of Esurance Car Insurance Quotes & More That Nobody is Discussing

Some of these you can manage, yet some are more hard to change. Your driving document: If you have been included in an accident or have actually obtained a ticket, you will pay even more than ordinary with the majority of insurance coverage carriers.

dui affordable auto insurance automobile low cost

dui affordable auto insurance automobile low cost cheapest car insurance cheap liability auto insurance

cheapest car insurance cheap liability auto insuranceWhere you live: Also the postal code you get in on a cars and truck insurance quote can influence your prices. Premiums are most likely to be higher in population-dense areas and cities, places where there are a lot more uninsured vehicle drivers, and also locations with high rates of theft or criminal damage – car insurance. Your credit history score: In many states, auto insurer will factor in your credit history as a part of what's called an insurance policy score (laws).

vehicle insurance auto prices car insurance

vehicle insurance auto prices car insuranceYour insurance provider: Different business may be much more forgiving concerning offenses or inadequate debt than others. You could obtain prices that are thousands of bucks apart for the exact same automobile, depending on that you get a quote from – cars. Find out more concerning how auto insurance coverage premiums are calculatedWe don't sell your info to 3rd parties.

Most business allow you to obtain automobile insurance coverage quotes online. You can likewise deal with an independent broker to contrast numerous quotes with one application (cheapest auto insurance). Both of these alternatives are free and https://tinyurl.com enable you to get quotes quickly. When getting a quote, you ought to be prepared to share some details concerning yourself and your vehicle.

You ought to additionally understand: When you want your brand-new policy to begin, The year your lorry was made, The make as well as version of your cars and truck, The lorry recognition number (VIN) of the automobile you desire to guarantee, Whether your own your car or lease it, How several miles you drive annually, Finally, you will certainly need to give some details concerning your household when obtaining a car insurance quote – cars.

All About Car Insurance – Get A Free Online Auto Quote – Liberty Mutual

You should also stay clear of concurring to make higher payments than you can afford.

Just how long is an insurance coverage quote great for? It depends upon the insurance provider. low cost. Numerous sites permit you to communicate with your quote by adding or deducting protection for more than 10 mins before the session is ended for lack of exercise. You can likewise usually look for your old quote as long as you make a note of your quote's ID number.

Your rates should remain the very same, as long as it's not long after your initial request, Can you obtain insurance quotes without registering? You don't need to register with a firm to get an auto insurance policy quote – car insurance. If you're not sure concerning a plan, you can ask for as several quotes from the exact same insurance service provider as you desire without paying for it (automobile).

The cash we make aids us offer you accessibility to complimentary credit history and also reports as well as assists us create our other terrific tools as well as academic products. low cost auto. Payment may factor right into exactly how and where items appear on our platform (as well as in what order). Considering that we typically make money when you locate a deal you such as and get, we try to show you offers we believe are a great suit for you.

Certainly, the deals on our system don't represent all monetary items around, however our objective is to show you as lots of excellent options as we can – credit. Car insurance policy quotes are a price quote of just how much you'll spend for an insurance coverage based upon the coverage kinds, limits and deductibles you choose (low cost auto).

All about Compare Car Insurance Quotes: Get Personalized Rates (2022)

However there's a lot even more to an insurance policy quote than simply how much you'll pay – auto insurance. Insurance coverage quotes consist of useful info regarding what the policy will and also won't cover, exactly how much the business will pay for a covered occurrence (your insurance coverage limit), and also what your out-of-pocket cost will certainly be if you need to sue.

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.